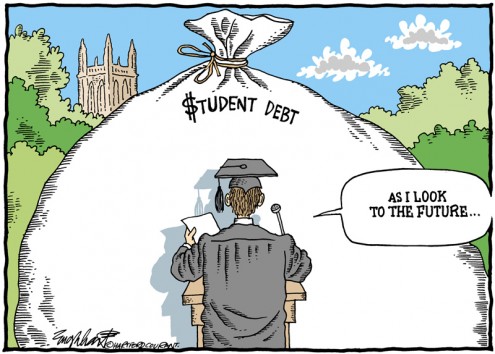

Whether you are considering vet school as a possibility for the future, beginning your degree now, or already well on your way to becoming a veterinarian; veterinary student debt going to be on your mind.

Depending on where you live, the costs to complete veterinary school can easily run into the hundreds of thousands of dollars. That’s a big, daunting price tag on pursuing one’s dream career, and for many it means the end to that dream.

But how much of a barrier does the cost of vet school really present?

The Definitive Guide to Overcoming Veterinary School Debt

In this guide you’ll find the most helpful tips, insights, and resources related to veterinary student debt. We’ve broken it down into 5 parts, covering everything from a breakdown of the costs, stories from other vet students, resources you can take advantage of, and even inspiration for how to make more money during your career. Armed with this information, along with your own dedication, your student loans can become just another stepping stone on the way to a happy, debt-free future.

We might as well get the scary stuff out of the way first…

1. How Much Does Veterinary School Cost?

The goal for all students attending vet school is essentially the same: obtain a degree in veterinary medicine (and then save the world).

Despite this consistent aim, the school you attend can significantly influence your future. Veterinary schools differ in price both overall, and based on where you are located in relation to that school.

For students hoping to attend a veterinary school in the United States, this cost of education map and this school comparison tool help break down the different costs between schools (living expenses and tuition for both in-state and out of state students). As an added bonus, the first also shows the NAVLE pass rate from previous years’ students. Be sure to check this out if you’re still deciding which school to attend.

As you will see, it is much more expensive to attend an out-of-state school. In Canada, schools charge one tuition rate for domestic students (Canadians), and a higher rate for international students.

Estimated Yearly Cost to Attend Veterinary School in North America

- Tuition: United States: In-State $32k (Out-of-State $45k) // Canada: Domestic $9k / International $46k

- Room and Board: $15k

- Books and Supplies: $2k

- Miscellaneous (Netflix, Wine, Pizza, More Wine, Cell Phone, Dog Food): $5k

This means that the average veterinary student in the United States needs to spend over $200,000 for their four year degree!

These are of course only estimates, and the real totals can vary greatly depending on the school you attend and the budget you adhere to. The major takeaway here related to overcoming veterinary student debt, is to (whenever possible) attend a school in the same region in which you live.

2. You’re Not Alone

Despite how terrifying the growing mountain of your veterinary school debt may be (and whether or not it needs to be), there’s something comforting about knowing you’re not facing this issue alone.

While a lot of what you read might show that vet school debt affects nearly everyone in the veterinary field, and that a clear solution has yet to be found, there are still many stories with happy endings.

Scary: Veterinary students face the highest debt-income ratio of any medical professional (nearly double that of M.D.’s).

Still Scary: Veterinary student debt continues to climb.

A little scary, a little hopeful: Solid debt management can help you pay off your vet school loans much faster.

Very Promising! Here’s the story of a student who successfully paid off her student loans in only five years.

3. Learn How to Manage Your Money & Your Vet School Debt

You may not be able to control the cost of vet school tuition, but you can control your personal finances. Effective money management can be an incredibly powerful weapon not only in helping you conquer your vet student loans, but in building wealth for the rest of your life too.

One of the most common things you’ll hear from vet school graduates: “Create a solid financial plan before it’s too late!”

Here are some websites and resources that can help you create this plan: (the sooner you get started, the better off you’ll be)

- Mr. Money Mustache (Being financially ready to retire at 30 sounds pretty nice, doesn’t it?)

- Income-Based Repayment (Learn about the various options you have for repaying your vet student loans)

- Types of Financial Aid Available to You (From grants and scholarships to even joining the army – you aren’t limited to only one option)

- Student Loan Repayment Options for Veterinarians (Overview of IBR vs. PAYE vs. REPAYE)

- AVMA (the American Veterinary Medical Association has compiled a great list of personal financial planning resources)

- Personal Finance for Dummies (It’s never dumb to be smart about your money!)

4. Apps & Tools to Help You Budget

Let technology be your friend (both in your education, and in managing your veterinary school debt). Here are a few apps and tools that can help you stay on top of your finances:

- Student Loan Repayment Simulator

- Mint (Probably the most popular personal finance management app around)

- More App Ideas…

5. Inspiration to Help You Make More Money Throughout Your Career

If you’re already budgeting effectively, earning more money is the ultimate way to quickly vanquish your veterinary school debt.

The average salary for a veterinarian in the United States is around $100,000. But, the actual number varies greatly from vet to vet, and that does not mean you will start making that amount as soon as you graduate. Thankfully, there are many things you can do to either increase your salary as a veterinarian, or earn more money on the side:

While still in school, pursue opportunities to earn extra money. Scholarships, part-time jobs on-campus, or serving as a company’s student rep, are all money earning opportunities that won’t eat up too much of your time.

There are many career paths that can be pursued with a degree in veterinary medicine. Learn about all the opportunities available (and the expected compensation), and try to keep as many doors open as possible. You never know where you’ll end up!

Find a side gig to supplement your primary source of income. Whether it’s guest writing articles for a publication, consulting for a company, or even pursuing an entrepreneurial venture: side gig’s are a fantastic way to increase your income (and you might be surprised by the opportunities to earn extra money doing something you’d do for free anyway).

- The Smart Passive Income blog and 4 Hour Work Week are both great resources for learning more about creating additional revenue streams (that don’t force you to work around the clock).

tl;dr – Here’s Our Top 5 Suggestions for Overcoming Veterinary Student Debt:

- Try to find a school close to home

- Keep your costs low

- Supplement your income

- Take a proactive approach to your finances: start early, educate yourself, and check-in regularly

- (and to make everything much easier) Marry somebody rich! 😉

Hindsight is 20/20. So do your research, learn from vets who’ve already overcome their debt, implement your strategy as early as possible, and enjoy a rewarding, debt-free veterinary career.

Whether you’re debt-free or not, veterinary education is a significant investment. EasyAnatomy makes learning and referencing canine anatomy more convenient, engaging, and rewarding.

EasyAnatomy’s adaptive quizzes ensure you’re always efficient and focusing on where you need to improve, and the anatomist-written descriptions focus on what you need to know for dissection labs and clinical practice. Best of all, it’s free to download, and comes with a wide variety of optional in-app upgrades to help take your knowledge to the next level.

Learn More & Maximize Your Vet School Investment >>